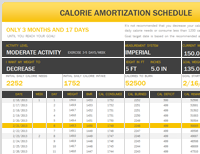

The scheduling of the mortgage loan with a detailed payment table which states how the payments will be calculated periodically. The need to pay off debt on time and there has to be regular pay off which will include the interest too. The calculation is done on the basis of the principal against the percentage of interest which makes up for the amortization schedule. This scheduling will help the borrower to know the portion of the payment made to pay off the debt which is used in the interest payment and the remaining portion for the premium from the principal after the payment is made each time. Find out more on amortization calculator with extra payments .

Types of amortization methods

There are different types of amortization methods employed to get them tabular form

- There is linear amortization

- The declining balance amortization

- Annuity amortization

- All at once amortization

- Large end payment amortization

- There is also negative amortization

It has to be noted that amortisation is always focused on chronological manner. This is based on the origination date of the when the loan was taken. It has to be noted by the borrower will have to make the last payment of the loan installment will differ from the ones previously paid. This table of amortization will help break down the whole loan into interest and the portions which have the principal. It will give an up to date analysis of how much interest and principal was paid to a certain date and what is the remaining balance that would have to be paid by the borrower on each date of payment.

How the calculation takes place

The whole scheduling of the table for amortization is based on assumptions that are put into perspective in acknowledging the facts wherein, to keep a check on the rounding off of errors that may occur when the interest is divided into installments, to avoid a cumulative error add up, the final payment in the loan is adjusted. It has to be noted when you mortgage a house for a certain number of years then, the lender will make sure that the certain number of initial years will have a disparate allocation of the payments that are made monthly by the lender. Hence, we can infer from this that the majority of the payment goes in paying off the interest rate and the remaining contribution of the payment goes in for the payment of the principal. The final payment will even out interest errors.

There is a method adopted to calculate the outstanding loan balance wherein the borrower is made aware of the present value of the payments that are remaining at the interest rate at which the loan is given. The amount will usually consist of the principal. To calculate the monthly payment of the loan, you will have to utilize the annuity formula and calculate the installment amount at each payment date. The usual method that the lenders employ when they make a contract with the borrower by placing the balloon payment method, which will cause for a fee if you end up paying the amount early, as the lender will not benefit if the loan will not hold full term.