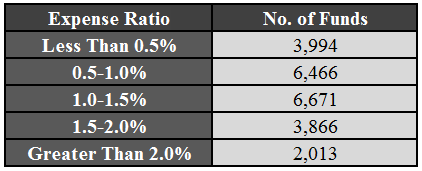

There are currently over 16,000 investment funds in this country, according to the Association of Financial and Capital Markets Entities. This application has become popular because investors gain access to securities they would not have individually. That is, by joining such a fund, it can buy highly valued shares of shares, for example, which would not be feasible if it were not for joint investment. In addition, it is much more comfortable and some investors consider it safer to leave fund management to those who really understand the financial market. The Common Sense on Mutual Funds Summary will help you out there.

Mutual Funds: How Does It Work?

As we have seen so far, by placing money in an investment fund, you sign a contract and outsource investment management to financial market specialists, or companies formed by these professionals. They will be responsible for making decisions, always seeking the highest possible return for each investor.

But that’s not the main feature that explains how the application works. The best way to explain it may be in comparison to a condominium. Yes, something similar to a set of apartments.

Want to see?

In a condominium, each owner has a part of the total, which varies according to the amount invested one, two or more units. In the investment fund, the apartment is equivalent to a quota. That is, they all have the same size and characteristics. What changes, then, is the number of shares the investor has.

The total value of the fund is calculated as the sum of the value of all quotas, which varies daily, according to factors related to the market and the financial product itself. After investing the value to buy a certain number of shares, all you have to do is keep track of the fund’s profitability by keeping an eye on managers’ financial investments.

These applications will follow rules set forth in the contract, depending on the type of fund. This means that you will know in advance the degree of risk involved and the type of investment possible. The manager of a conservative investment fund such as fixed income, for example, will not buy stocks because they have variable income and are typical of less conservative investment funds, where there is a higher risk involved. This you discover before, in complete transparency, without being caught off guard.

It’s easy to understand, right?

Before moving on to fund types, it is worth taking a few minutes to understand the rates involved in this investment model.

Fees involved

Like any other type of investment, funds have fees for those who invest in them.

They need to be taken into account when calculating the profitability of each fund and choosing the most beneficial alternative for you.

How to do this?

The first tip is to read the application informational material, because some rates are optional such as the exit rate, while others tend to vary for each model. Let’s talk now about the main ones.

Performance rate

The performance fee is charged to the quota holder every six months, but only if the fund’s profitability exceeds its benchmark. Thus, if managers have made decisions that outperform, they are paid for it. Therefore, the fee is charged only on profitability that exceeds the benchmark.